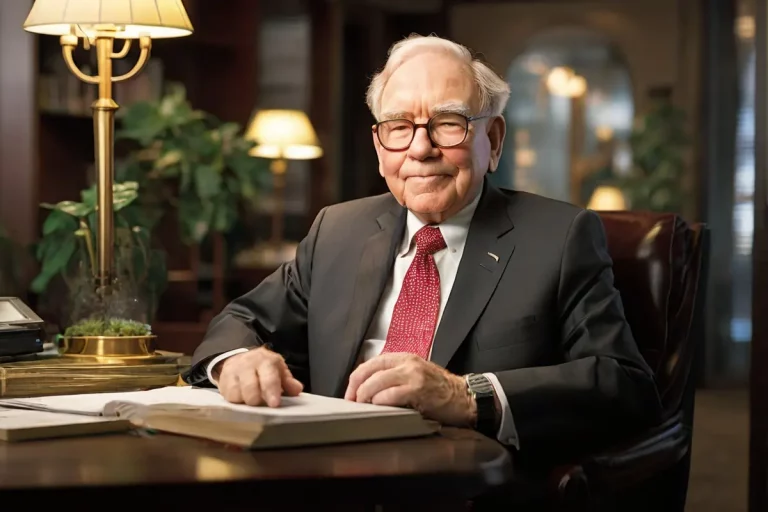

Warren Buffett is one of the most successful and influential investors of all time. Warren Buffett stands out as one of the most accomplished and influential investors in history. As the chairman and CEO of Berkshire Hathaway, overseeing a conglomerate with various businesses in diverse sectors. He has pledged to donate most of his wealth to charitable causes, earning recognition for his philanthropy.

But how did Warren Buffett build and preserve his legacy? What are the principles that guide his decisions and actions? What lessons can we draw from his example? This article will delve into these questions and beyond.

Table of Contents

ToggleThe Start of Warren Buffett’s Investment Journey

Warren Buffett, born in 1930, is from Omaha, Nebraska. He showed an early interest in business and finance, selling newspapers, magazines, and gum as a child. He also invested in the stock market, buying his first shares at the age of 11.

He attended the University of Nebraska, where he graduated with a bachelor’s degree in business administration. He then enrolled at Columbia Business School, where he learned from Ben Graham, the father of value investing. Graham taught Buffett the concept of intrinsic value, which is the true worth of a business based on its assets, earnings, and growth potential.

Founding Buffett Partnership Ltd

After graduating from Columbia, Buffett worked as a securities analyst and a portfolio manager. In 1956, he founded Buffett Partnership Ltd, a private investment partnership that pooled money from family and friends. He applied Graham’s value investing principles, looking for undervalued and overlooked companies that had strong fundamentals and competitive advantages.

Buffett Partnership Ltd achieved an impressive yearly average return of 29.5%, outperforming the 7.4% of the S&P 500 index. The date of analysis is between 1957 and 1968.

In this time, he also made some of his most famous investments, such as Coca-Cola , American Express and GEICO.

Warren Buffett’s Big Investments

Coca-Cola

In 1988, Buffett started buying shares of Coca-Cola, the world’s largest beverage company. Its strong brand, loyal customers, and global distribution network attracted him.

He also thought Coca-Cola was really strong because it had something special that kept it safe from competitors.

Buffett invested $1.3 billion in Coca-Cola, acquiring a 6.3% stake. Today, his stake is worth over $20 billion, making it one of his most profitable investments. He has also received billions of dollars in dividends from Coca-Cola over the years.

American Express

In 1964, Buffett bought shares of American Express, the leading credit card company. He saw an opportunity when the company’s stock price plunged after a fraud scandal involving one of its cooperatives. He saw that the problem didn’t really hurt the main business of American Express, which was still doing well and making money.

Buffett invested $13 million in American Express, acquiring a 5% stake. He later increased his stake to 18%, making it one of his largest holdings. He sold most of his shares in 2020, but still owns a 1.3% stake worth over $2 billion.

GEICO

In 1951, Buffett found GEICO, a car insurance company that gave affordable policies to government employees and military personnel. Its low-cost business model, high customer retention, and large market potential impressed him. He bought some shares for himself and for his partnership.

In 1976, Buffett bought more shares of GEICO, acquiring a 33% stake. He later increased his stake to 50%, making GEICO a cooperative of Berkshire Hathaway. Now the company is the second-largest car insurer in the US. GEICO today is covering over 17 million policies and collecting $35 billion in premiums.

- The Psychology of Money: Understanding the Strange and Human Side of Financial Decision-Making

- The Top 12 Investing Hacks from Fred Schwed

- Choosing the Best Investment Bank: Charles Schwab, Fidelity, or Vanguard

- Weekly Savings Challenge 2024: A Guide to Boost Your Savings

- Why Fintech is the Future: Reshaping the Banking Industry

Warren Buffett Legacy in the Business World

Berkshire Hathaway Growth

In 1962, Buffett started buying shares of Berkshire Hathaway, a struggling textile company. He intended to sell the shares back to the management at a higher price, but the deal fell through. He then decided to take control of the company and use it as a vehicle for his investments.

Under Buffett’s leadership, Berkshire Hathaway transformed from a textile manufacturer to a diversified conglomerate. It acquired and invested in dozens of businesses in various sectors, such as insurance, energy, transportation, retail, and technology. It also invested in stocks from major successful companies like Apple, Bank of America, and Coca-Cola.

Today, Berkshire Hathaway is one of the most valuable and respected companies in the world. It’s worth over $600 billion, and the stock price has surged by over 2,000,000% since Buffett took charge. It also has a loyal and fervent shareholder base, who attend its annual meetings, dubbed the “Woodstock of Capitalism”.

Buffett’s Investment Philosophy

Buffett learned the principles of value investing from Ben Graham, forming the foundation of his investment philosophy. He looks for businesses that have strong fundamentals, competitive advantages, and growth potential. He seeks to buy them at a price lower than their true value. By using methods such as discounted cash flow analysis, earnings multiples, and book value.

Buffett also follows some rules and guidelines that help him make better decisions and avoid mistakes. Some of these rules are:

- Exhibit caution when others are exuberant, and display opportunism when others are apprehensive. This means that Buffett avoids following the crowd and instead takes advantage of market fluctuations to buy low and sell high.

- Invest in what you know and understand. Buffett avoids investing in businesses or industries he doesn’t understand.

- Think long-term and ignore short-term noise. This means Buffett prioritizes the long-term performance and prospects of a business over short-term stock price fluctuations. He disregards analysts, media, and others’ predictions, relying on his own research and judgment.

- Be patient and disciplined. This means that Buffett waits for the right opportunities to invest, and does not act on impulse or emotion. He also sticks to his investment criteria and does not compromise on quality or price.

Influence on Other Investors

Buffett’s investment philosophy and success have inspired and influenced many other investors, both professional and amateur. Some of his most prominent followers and admirers are:

- Charlie Munger, Buffett’s longtime business partner and vice chairman of Berkshire Hathaway. Munger is a value investor with a broad approach, drawing insights from fields like psychology, economics, and philosophy.

- Bill Ackman, the founder and CEO of Pershing Square Capital Management, a hedge fund that focuses on activist investing. He is known for investing in undervalued or troubled companies. After that he actively supports implementing changes in their management, strategy, or governance.

- Mohnish Pabrai, founder and managing partner of Pabrai Investment Funds, a hedge fund family focusing on value stocks. Pabrai is also a philanthropist, donating millions to causes like education, health, and helping people who are poor.

- Guy Spier, the founder and manager of Aquamarine Capital, a value-oriented investment partnership. He is also the author of the book “The Education of a Value Investor”. This book detail his experiences and lessons as an investor.

Philanthropy as Part of Warren Buffett Legacy

Buffett is not only a legendary investor, but also a generous philanthropist. He committed to donating the majority of his wealth to charitable causes, focusing on health, education, and social justice. He has also encouraged other wealthy individuals to do the same, through initiatives such as:

The Giving Pledge

Launched in 2010 by Buffett and Microsoft co-founder Bill Gates, The Giving Pledge urges billionaires to pledge a substantial part of their wealth to philanthropy. The campaign invites billionaires to pledge at least half of their wealth to philanthropy, either during their lifetime or in their will. As of 2021, over 200 billionaires from 23 countries have joined the pledge, representing a combined wealth of over $1 trillion.

Bill & Melinda Gates Foundation Donation

The Bill & Melinda Gates Foundation is the world’s largest private foundation, with an endowment of over $50 billion. The foundation strives to improve worldwide well-being and lessen inequality by tackling issues such as global health, education, and poverty.

In 2006, Buffett declared he’d give most of his Berkshire Hathaway shares to the foundation in yearly portions. The historic donation is expected to exceed $100 billion. Buffett also serves as a trustee of the foundation, along with Bill and Melinda Gates.

Maintaining the Warren Buffett Legacy

Buffett is now 93 years old, and has been running Berkshire Hathaway for over 50 years. He has not announced any plans to retire, but he has prepared for the succession of his company and his wealth. He named two trusted deputies, Ajit Jain and Greg Abel, as vice chairmen of Berkshire Hathaway, granting them increased responsibility and authority in the company’s operations. He has also named Todd Combs and Ted Weschler as his investment managers, and has delegated some of his stock-picking duties to them.

Buffett set up a trust to share his remaining Berkshire Hathaway shares with his family and for charitable purposes as he wanted. He wrote a letter to his trustees, explaining his principles and expectations for the future of Berkshire Hathaway and its culture.

Conclusion: Final thoughts

Warren Buffett is a remarkable example of how one can build and preserve a lasting and impactful legacy. He has achieved extraordinary success as an investor, a business leader, and a philanthropist. He has also shared his wisdom and experience with millions of people, through his letters, speeches, books, and interviews.

Buffett’s legacy isn’t just gauged by his riches; it’s also defined by his values, vision, and generosity. He demonstrated that we can generate value for both ourselves and others by staying true to our principles and passions. He has also shown us that it is important to give back to the society and the world that have given us so much.

We hope that this article has inspired you to learn more about Warren Buffett and his legacy. If you have any questions or comments, please feel free to leave them below. Thank you for reading!