Table of Contents

Toggle- Introduction

- Who is Warren Buffett?

- Buffett’s Investing Philosophy

- Understanding Stock Market Trends

- How Do Trends Affect Investments?

- Buffett’s Take on Stock Market Trends

- Risk Management in Following Trends

- Stock Picking Wisdom from Buffett

- Learning from Past Market Trends

- Common Mistakes to Avoid

- Conclusion: Final Thoughts

- FAQ

Introduction

The stock market is a dynamic and complex system that reflects the collective behavior of millions of investors. It is influenced by various factors, such as economic conditions, political events, corporate earnings, consumer sentiment, and more. These factors create patterns of movement in the prices of stocks, which are known as stock market trends. Let’s dive into Warren Buffett Stock Market Trends.

Stock market trends can be classified into three main types: upward, downward, and sideways. An upward trend, also called a bull market, is characterized by rising prices and increasing investor confidence. A downward trend, also called a bear market, is marked by falling prices and declining investor optimism. A sideways trend, also called a range-bound market, is when prices fluctuate within a narrow band and show no clear direction.

Stock market trends can have a significant impact on the performance of your investments. Therefore, it is important to understand how to identify and navigate them effectively. One of the most successful and respected investors in the world, Warren Buffett, has a lot of wisdom to share on this topic. In this article, we will explore some of his insights and strategies on how to deal with stock market trends and make smart investment decisions.

Who is Warren Buffett?

Warren Buffett is the chairman and CEO of Berkshire Hathaway, a global conglomerate that owns and operates various businesses, such as GEICO, Coca-Cola, Apple, and more.

He is widely regarded as one of the greatest investors of all time, having amassed a net worth of over $100 billion as of 2023.

He is also known for his philanthropy, having pledged to donate most of his fortune to charitable causes.

Buffett started investing at the age of 11, buying his first shares of stock for $38 each. He learned the basics of investing from his father, who was a stockbroker, and from reading books by Benjamin Graham, the father of value investing. Value investing is an approach that focuses on finding undervalued companies that have strong fundamentals and competitive advantages. Buffett adopted this philosophy and applied it to his own investment style, which he later refined and developed over the years.

Buffett’s investing philosophy is based on the principle of buying quality businesses at fair prices and holding them for the long term.

He looks for companies that have durable competitive advantages, such as strong brands, loyal customers, high profit margins, and low debt.

He also looks for companies that have capable and honest management, who can allocate capital efficiently and ethically.

He avoids companies that are in declining or uncertain industries, such as airlines, newspapers, or technology.

He also avoids companies that are overpriced or speculative, such as those that trade at high multiples of earnings or have no earnings at all.

Buffett’s investing philosophy has proven to be very successful and profitable over the decades. His company, Berkshire Hathaway, has delivered an average annual return of 20.3% from 1965 to 2020, compared to 10.2% for the S&P 500 index. This means that $10,000 invested in Berkshire Hathaway in 1965 would have grown to over $300 million by 2020, while the same amount invested in the S&P 500 would have grown to only $2 million.

Buffett’s Investing Philosophy

Buffett’s investing philosophy is based on the principle of buying quality businesses at fair prices and holding them for the long term. He looks for companies that have durable competitive advantages, such as strong brands, loyal customers, high profit margins, and low debt. He also looks for companies that have capable and honest management, who can allocate capital efficiently and ethically. He avoids companies that are in declining or uncertain industries, such as airlines, newspapers, or technology. He also avoids companies that are overpriced or speculative, such as those that trade at high multiples of earnings or have no earnings at all.

Buffett’s investing philosophy has proven to be very successful and profitable over the decades. His company, Berkshire Hathaway, has delivered an average annual return of 20.3% from 1965 to 2020, compared to 10.2% for the S&P 500 index. This means that $10,000 invested in Berkshire Hathaway in 1965 would have grown to over $300 million by 2020, while the same amount invested in the S&P 500 would have grown to only $2 million.

Understanding Stock Market Trends

Stock market trends are the patterns of movement in the prices of stocks over time. They can be classified into three main types: upward, downward, and sideways.

An upward trend, also called a bull market, is characterized by rising prices and increasing investor confidence.

A downward trend, also called a bear market, is marked by falling prices and declining investor optimism. A sideways trend, also called a range-bound market, is when prices fluctuate within a narrow band and show no clear direction.

Stock market trends can be observed at different time frames, such as daily, weekly, monthly, or yearly. They can also be measured by different indicators, such as moving averages, trend lines, or chart patterns. However, there is no definitive or objective way to identify or predict stock market trends, as they are influenced by various factors, such as economic conditions, political events, corporate earnings, consumer sentiment, and more. Therefore, different investors may have different opinions or interpretations of the same trend.

Stock market trends can have a significant impact on the performance of your investments. Therefore, it is important to understand how to identify and navigate them effectively. One of the most successful and respected investors in the world, Warren Buffett, has a lot of wisdom to share on this topic. In the next sections, we will explore some of his insights and strategies on how to deal with stock market trends and make smart investment decisions.

Here are some examples of stock market trends:

Upward Trend

An upward trend, also called a bull market, is characterized by rising prices and increasing investor confidence. The price of the stock makes higher highs and higher lows, indicating a strong demand and a positive outlook. The slope of the trend line is positive, showing an upward direction. An example of an upward trend is the S&P 500 index from 2009 to 2020, which increased from around 700 points to over 3700 points, reaching new record highs.

Downward Trend

A downward trend, also called a bear market, is marked by falling prices and declining investor optimism. The price of the stock makes lower lows and lower highs, indicating a weak supply and a negative outlook. The slope of the trend line is negative, showing a downward direction. An example of a downward trend is the S&P 500 index from 2007 to 2009, which dropped from around 1500 points to below 700 points, losing more than half of its value.

Sideways Trend

A sideways trend, also called a range-bound market, is when prices fluctuate within a narrow band and show no clear direction. The price of the stock oscillates between a support level and a resistance level, indicating a balance between supply and demand. The slope of the trend line is zero, showing a horizontal direction. An example of a sideways trend is the S&P 500 index from 2015 to 2016, which traded between around 1800 points and 2100 points, with no significant breakout or breakdown.

How Do Trends Affect Investments?

Stock market trends can have a significant impact on the performance of your investments. Depending on the type and direction of the trend, you may experience different outcomes, such as gains, losses, or stagnation. Therefore, it is important to understand how to adapt your investment strategy to the prevailing market trend.

Generally speaking, the best time to invest is when the market is in an upward trend, as you can benefit from the rising prices and the positive sentiment. However, you should also be careful not to overpay for the stocks, as they may become overvalued and prone to a correction. You should also be prepared for the possibility of a reversal, as no trend lasts forever.

The worst time to invest is when the market is in a downward trend, as you can suffer from the falling prices and the negative sentiment. However, you should also not panic and sell your stocks at a loss, as they may recover in the future. You should also look for opportunities to buy undervalued stocks, as they may offer a high return potential when the market rebounds.

The most challenging time to invest is when the market is in a sideways trend, as you can experience little or no growth in your portfolio. However, you should also not lose hope and give up on investing, as the market may break out of the range eventually. You should also diversify your portfolio, as different sectors or industries may perform differently in a range-bound market.

One of the most successful and respected investors in the world, Warren Buffett, has a lot of wisdom to share on how to deal with stock market trends and make smart investment decisions. In the next sections, we will explore some of his insights and strategies on how to follow stock market trends and achieve long-term success.

Buffett’s Take on Stock Market Trends

Warren Buffett is not a fan of following stock market trends blindly. He believes that the market is often irrational and driven by emotions, such as fear and greed, rather than by fundamentals, such as earnings and growth. He also thinks that the market is uncertain and volatile, and that trying to time the market or chase the latest fads is futile and risky.

Instead, Buffett focuses on the intrinsic value of the businesses he invests in, rather than on the price movements of their stocks. He looks for companies that have durable competitive advantages, capable and honest management, and fair prices. He then holds them for the long term, regardless of the market fluctuations. He only sells them when their fundamentals decay, or when he finds a better opportunity elsewhere.

Buffett’s approach to stock market trends is based on the following principles:

- Long-term investing strategy: Buffett believes that the best way to achieve long-term success in the stock market is to invest in quality businesses and hold them for the long term.

- He says that his favorite holding period is forever, and that he only buys stocks that he would be happy to own even if the market shut down for 10 years. He also says that he does not care about the daily or weekly fluctuations of the market, as they are irrelevant to his long-term goals. He advises investors to ignore the noise and focus on the signal, which is the underlying performance of the businesses they own.

- Value over price: Buffett believes that the value of a business is determined by its future cash flows, not by its current stock price. He says that the price is what you pay, but the value is what you get. He also says that the market is a voting machine in the short term, but a weighing machine in the long term.

- This means that the market may misprice a stock in the short term, based on the popularity or sentiment of the investors, but it will eventually reflect its true value in the long term, based on its earnings and growth. He advises investors to look for undervalued stocks, which are those that trade below their intrinsic value, and avoid overvalued stocks, which are those that trade above their intrinsic value.

- When to buy stocks: Buffett believes that the best time to buy stocks is when they are cheap, not when they are expensive. He says that he likes to buy stocks when they are on sale, and that he is fearful when others are greedy.

- He also says that he likes to be a contrarian, and that he goes against the crowd when he sees an opportunity. He advises investors to look for bargains in the market, which are those stocks that have been beaten down by the market, but have strong fundamentals and competitive advantages. He also advises investors to have a margin of safety, which is the difference between the price and the value of a stock, and to buy with a long-term perspective, not with a short-term speculation.

- When to sell stocks: Buffett believes that the best time to sell stocks is when they are overpriced, not when they are underpriced. He says that he likes to sell stocks when they are too expensive, and that he is greedy when others are fearful.

- He also says that he likes to be rational, and that he does not let his emotions interfere with his decisions. He advises investors to sell stocks when they are overvalued, which are those that trade above their intrinsic value, or when their fundamentals decay, or when they find a better opportunity elsewhere. He also advises investors to have a discipline, which is the ability to stick to their strategy and criteria, and to sell with a clear reason, not with a vague feeling.

Risk Management in Following Trends

Warren Buffett is not a risk-averse investor, but he is a risk-aware investor. He understands that investing in the stock market involves risks, and that following stock market trends can expose him to more risks. Therefore, he applies some risk management techniques to reduce his exposure and protect his capital.

Some of the risk management techniques that Buffett uses are:

- Diversification: Buffett does not put all his eggs in one basket, but he spreads his investments across different sectors, industries, and companies.

- He says that variety of investments is a protection against ignorance, and that it makes sense to own a variety of stocks, as long as they are well-selected and well-priced.

- He also says that variety of investments does not mean owning everything, but owning a reasonable number of stocks that he understands and trusts. He advises investors to diversify their portfolios, but not to over-diversify or dilute their returns.

- Quality: Buffett does not compromise on the quality of the businesses he invests in, but he looks for the best of the best. He says that quality is the most important attribute of a business, and that it is better to buy a wonderful company at a fair price than a fair company at a wonderful price to earnings.

- He also says that quality is more important than quantity, and that it is better to own a few outstanding stocks than a lot of mediocre ones. He advises investors to look for quality businesses, which have durable competitive advantages, capable and honest management, and consistent and growing earnings per share.

- Margin of safety: Buffett does not overpay for the stocks he buys, but he looks for a bargain. He says that the margin of safety is the difference between the price and the value of a stock, and that it is the key to successful investing.

- He also says that the margin of safety is the secret to avoiding losses, and that it is better to be conservative than optimistic in estimating the value of a stock. He advises investors to look for undervalued stocks, which trade below their intrinsic value, and to avoid overvalued stocks, which trade above their intrinsic value.

Stock Picking Wisdom from Buffett

Warren Buffett is not only a master of following stock market trends, but also a master of picking individual stocks. He has a knack for finding hidden gems in the market, and turning them into multi-bagger returns. He has invested in some of the most successful and iconic companies in the world, such as Coca-Cola, Apple, American Express, and more.

Buffett’s stock picking wisdom is based on the following criteria:

- Business model: Buffett looks for businesses that have simple and lucid business models, not complex and confusing ones. He says that he only invests in businesses that he can explain in one sentence, and that he avoids businesses that he does not understand or that have too many moving parts.

- He also looks for businesses that have a clear competitive edge, such as a strong brand, a loyal customer base, a high market share, or a low-cost advantage. He advises investors to look for businesses that have a moat, which is a barrier that protects them from competition and allows them to earn high returns on capital.

- Financial performance: Buffett looks for businesses that have consistent and growing financial performance, not erratic and declining ones. He says that he prefers businesses that have a history of increasing their earnings, revenues, cash flows, and dividends, and that he avoids businesses that have a history of losing money, burning cash, or cutting dividends. He also looks for businesses that have high profit margins, low debt levels, and high returns on equity. He advises investors to look for businesses that have a track record of creating value, not destroying it.

- Management quality: Buffett looks for businesses that have capable and honest management, not incompetent and dishonest ones. He says that he likes to invest in businesses that are run by managers who are passionate, visionary, and shareholder-friendly, and that he dislikes to invest in businesses that are run by managers who are greedy, short-sighted, or self-serving.

- He also looks for businesses that have a culture of excellence, innovation, and integrity. He advises investors to look for businesses that have a management team that they can trust, respect, and admire.

Learning from Past Market Trends

Warren Buffett is not only a student of the present market trends, but also a student of the past market trends. He learns from the history of the stock market, and applies the lessons to his current and future investments. He says that the past is a guide, not a gospel, and that he uses it to understand the cycles and patterns of the market, not to predict its exact movements.

Buffett’s learning from past market trends is based on the following sources:

Books: Buffett is an avid reader, and he reads a lot of books about the history of the stock market, the economy, and the businesses. He says that he spends about 80% of his day reading, and that he reads about 500 pages a day. He also says that he reads for knowledge, not for entertainment, and that he prefers books that are factual, rational, and timeless.

Some of the books he suggests are:

- The Intelligent Investor by Benjamin Graham: This is the book that introduced Buffett to the concept of value investing, and that influenced his investing philosophy. It teaches how to analyze stocks based on their intrinsic value, and how to avoid the emotional traps of the market.

- Security Analysis by Benjamin Graham and David Dodd: This is the book that taught Buffett how to evaluate the financial performance and condition of businesses, and how to calculate their fair value. It addresses subjects including balance sheets, income statements, cash flow statements, and more.

- Common Stocks and Uncommon Profits by Philip Fisher: This is the book that taught Buffett how to look for quality businesses, and how to assess their competitive advantages, growth potential, and management quality. It covers topics such as scuttlebutt, product innovation, customer loyalty, and more.

- The Essays of Warren Buffett by Lawrence Cunningham: This is the book that compiles Buffett’s annual letters to the shareholders of Berkshire Hathaway, and that summarizes his investing wisdom and principles. It covers topics such as business valuation, capital allocation, corporate governance, and more.

Reports: Buffett is a diligent researcher, and he reads a lot of reports about the current and historical performance and condition of the businesses he invests in, or have interest rates in. He says that he reads the annual reports, the quarterly reports, the 10-Ks, the 10-Qs, and any other relevant documents that provide him with useful information.

- He also says that he reads the reports carefully, critically, and thoroughly, and that he looks for the facts, not the opinions, of the management. He advises investors to read the reports of the businesses they own, or want to own, and to understand their strengths, weaknesses, opportunities, and threats.

Newspapers: Buffett is a curious observer, and he reads a lot of newspapers about the current and historical events and trends that affect the stock market, the economy, and the businesses.

He says that he reads about five newspapers a day, and that he reads them for information, not for advice. He also says that he reads the newspapers broadly, not narrowly, and that he looks for the big picture, not the small details. He advises investors to read the newspapers regularly, and to be aware of the macro and micro factors that influence the market and the businesses.

Common Mistakes to Avoid

Warren Buffett is not a perfect investor, and he has made some mistakes in his investing career. However, he learns from his mistakes, and he tries to avoid repeating them. He also shares his mistakes with others, so that they can learn from them too.

He says that the most common mistakes that investors make are:

- Following the herd: Buffett says that one of the biggest mistakes that investors make is following the herd, or doing what everyone else is doing, without thinking for themselves. He says that this leads to buying high and selling low, which is the opposite of what investors should do. He also says that this leads to missing out on great opportunities, or falling into traps. He advises investors to be independent, and to do their own research and analysis, before making any investment decisions.

- Speculating instead of investing: Buffett says that another common mistake that investors make is speculating instead of investing, or gambling on the short-term price movements of the stocks, instead of focusing on the long-term value of the businesses.

- He says that this leads to losing money, or making suboptimal returns, as the market is uncertain and volatile in the short term. He also says that this leads to paying high fees, taxes, and commissions, which eat away at the returns. He advises investors to invest, not speculate, and to buy and hold quality businesses for the long term, not trade or flip stocks for the short term.

- Being impatient: Buffett says that another common mistake that investors make is being impatient, or expecting quick and easy returns, instead of waiting for the compounding effect to work. He says that this leads to selling too soon, or buying too late, which reduces the returns. He also says that this leads to being frustrated, or giving up, which prevents the investors from achieving their goals. He advises investors to be patient, and to let time and compounding do their magic, as the stock market rewards those who wait.

Conclusion: Final Thoughts

Warren Buffett is one of the most successful and respected investors in the world, and he has a lot of wisdom to share on how to navigate stock market trends and make smart investment decisions. So, he is the best to analyze if the stock have a fair share price. In this article, we have explored some of his insights and strategies on how to:

- Identify and understand stock market trends, and how they affect investments

- Follow a long-term investing strategy, and focus on value over price

- Know when to buy and sell stocks, based on their intrinsic value and fundamentals

- Manage risk in following trends, by mix investments, choosing quality, and having a margin of safety

- Pick individual stocks, based on their business model, financial performance, and management quality

- Learn from past market trends, by reading books, reports, and newspapers

By following Buffett’s advice, you can stay ahead in the stock market game, and achieve long-term success and wealth. However, you should also remember that Buffett is not infallible, and that his methods may not work for everyone or in every situation. You should also do your own research and analysis, and develop your own investing style and criteria, before making any investment decisions.

FAQ

Here are some frequently asked questions and answers about stock market trends and Buffett’s investing philosophy:

Q: How do I calculate the intrinsic value of a stock?

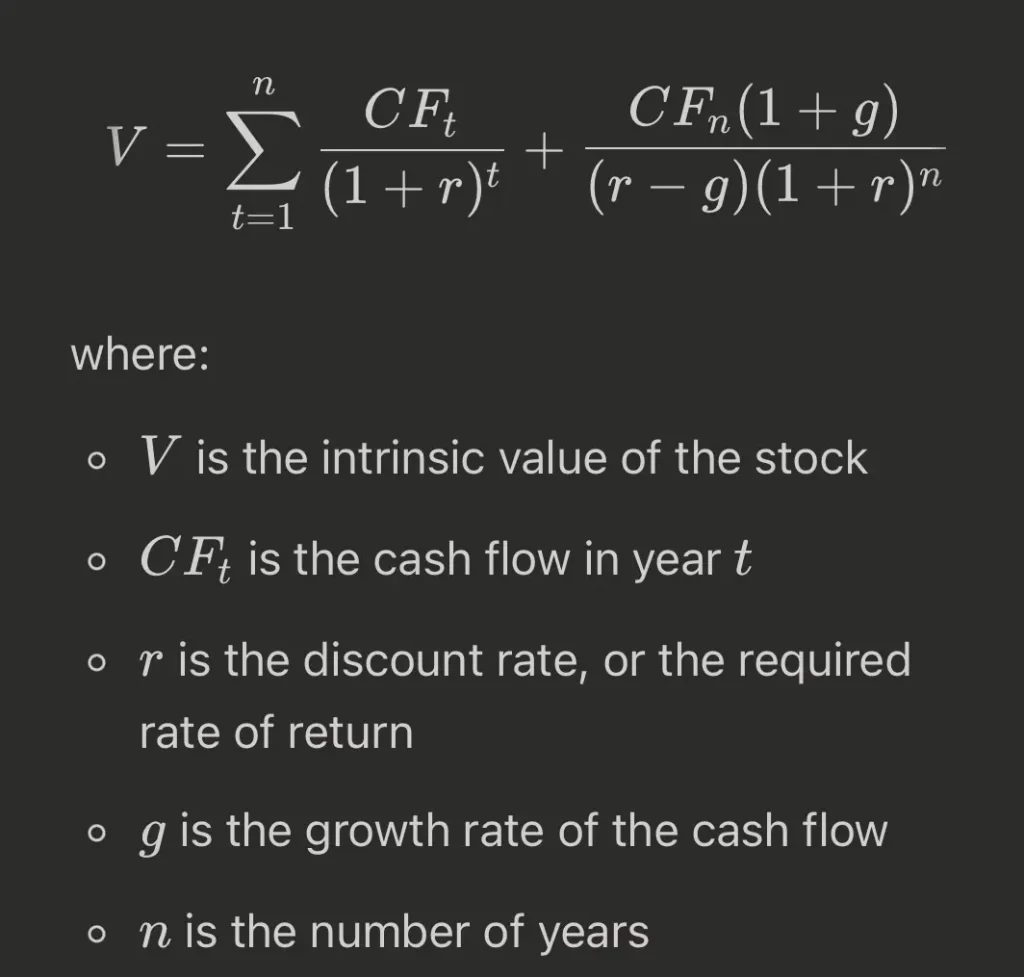

A: There is no definitive or objective way to calculate the intrinsic value of a stock, as different investors may have different assumptions, methods, and models. However, one of the most common and simple ways to estimate the intrinsic value of a stock is to use the discounted cash flow (DCF) method, which is based on the present value of the future cash flows of the business. The formula for the DCF method is:

To use the DCF method, you need to estimate the future cash flows of the business, the discount rate, the growth rate, and the number of years. You can find the historical cash flows of the business from its financial statements, and use them to project the future cash flows.

You can use the weighted average cost of capital (WACC) or the capital asset pricing model (CAPM) to estimate the discount rate. You can use the historical growth rate of the business, or the industry average, to estimate the growth rate. You can use the expected life span of the business, or a reasonable number, to estimate the number of years.

Once you have all the inputs, you can plug them into the formula, and get the intrinsic value a company. You can then compare it with the current market price of the stock, and see if it is undervalued or overvalued.

Q: How do I find quality businesses to invest in?

A: There is no definitive or objective way to find quality businesses to invest in, as different investors may have different preferences, criteria, and sources. However, one of the most common and effective ways to find quality businesses to invest in is to use a screening tool, which is a software or a website that allows you to filter and sort stocks based on various parameters, such as industry, sector, market cap, earnings, growth, dividends, and more.

To use a screening tool, you need to have a clear idea of what kind of businesses you are looking for, and what kind of metrics you are using to measure their quality. You can use the criteria that Buffett uses, such as durable competitive advantages, capable and honest management, consistent and growing earnings, high profit margins, low debt levels, and high returns on equity. You can also use your own criteria, based on your own research and analysis.

Once you have your criteria, you can input them into the screening tool, and get a list of stocks that match your criteria. You can then analyze each stock in more detail, and see if it meets your expectations and standards. You can also use other sources, such as reports, news, articles, blogs, podcasts, and more, to get more information and insights about the businesses you are interested in.

By using a screening tool, you can save time and effort, and find quality businesses to invest in more easily and efficiently. However, you should also remember that a screening tool is not a substitute for your own judgment and due diligence, and that you should always verify and validate the information and data that you get from the screening tool.