Table of Contents

ToggleIntroduction

Warren Buffett is widely regarded as one of the most successful investors of all time. Starting at a young age, he has built an incredible fortune through his investment strategies. In this blog, we will explore the key factors that contributed to Buffett’s success and provide insights on how to replicate it.

Starting young is a vital aspect of Buffett’s investment journey. At the age of 11, he made his first stock purchase, showing his early interest and commitment to investing. This early start allowed him to take advantage of the power of compound interest, which is one of the key principles that shaped his success.

This blog will focus on the relevance of starting young in investing and how it can significantly impact long-term wealth accumulation. By understanding Buffett’s journey, readers can gain valuable knowledge and learn from his experiences to make informed investment decisions.

The keyphrase “when Warren Buffett started investing” is highly relevant to this blog as it highlights the importance of the early stages of Buffett’s investment career. By optimizing this keyphrase in the introduction, readers will understand the focus of the blog and its connection to Buffett’s success.

In this blog, we will explore Buffett’s early experiences, his investment principles, and how they can be applied to replicate his success. By the end, readers will have valuable insights and strategies to begin their own successful investment journeys.

Starting Early: The Snowball Effect of Compound Interest

Warren Buffett’s success as an investor can be attributed in part to his early start in the world of finance. At the young age of 11, Buffett made his first stock purchase, buying three shares of Cities Service preferred at $38 per share. This early interest and commitment to investing allowed him to take advantage of the power of compound interest, which has played a significant role in his wealth accumulation.

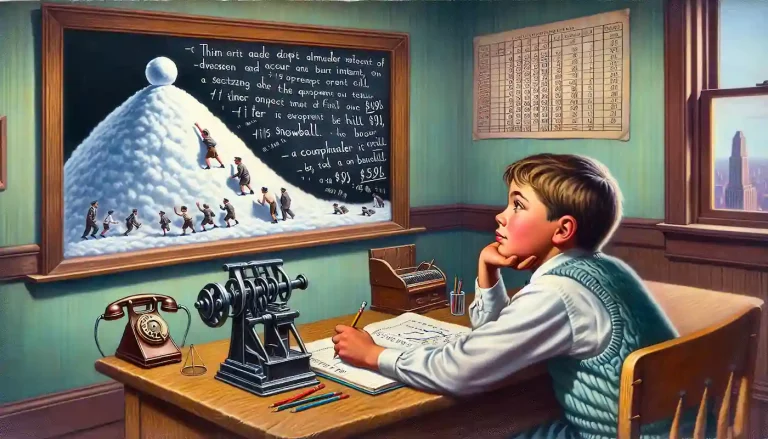

Compound interest refers to the concept of earning interest on both the initial investment and the accumulated interest over time. As the interest compounds, the growth rate increases, creating a “snowball effect” that can lead to substantial wealth accumulation. Starting young provides the advantage of time, allowing the snowball to gather momentum as it rolls down a long hill.

When Warren Buffett started investing, he recognized the importance of starting early and taking advantage of compound interest. He compared the growth of wealth to a snowball made of sticky snow, which gets bigger and bigger as it rolls down a long hill. The longer the snowball rolls, the more snow it picks up, and the larger it becomes.

The same principle applies to investing. By starting young, individuals have more time for their investments to grow and compound over the years. This gives them a significant advantage in building wealth compared to those who start later in life.

Starting early also allows for more room to make mistakes and learn from them. Young investors have the opportunity to gain valuable experience and knowledge over time, making them better equipped to navigate the complexities of the investment world.

It’s important to note that starting early doesn’t guarantee success, but it significantly increases the likelihood of building substantial wealth. By taking advantage of compound interest and starting young, investors can set themselves up for long-term financial success.

Investing in Smaller Companies

Warren Buffett’s investment strategy involves focusing on smaller companies, especially when he started his investment journey. By investing in smaller companies, Buffett was able to work with smaller sums of money, which had several advantages.

Firstly, investing in smaller sums allows for greater flexibility and diversification. It allows investors to spread their investments across multiple companies, reducing the risk associated with investing in a single large company. This approach aligns with Buffett’s philosophy of not putting all his eggs in one basket.

Secondly, investing in smaller companies presents the opportunity to find overlooked opportunities. Larger companies tend to have more analysts and media coverage, making it harder to find undervalued stocks. In contrast, smaller companies may be less closely followed, which increases the potential for finding hidden gems.

Furthermore, compared to the past, the investment landscape has changed. When Warren Buffett started investing, there were more opportunities to find undervalued stocks. However, with advancements in technology and the increased accessibility of information, it is more challenging to find such opportunities. Investing in smaller companies can be a way to uncover overlooked opportunities that may not be as easily identified in larger, more widely known companies.

Investing in smaller companies does come with its own set of risks. Smaller companies may be more volatile and less stable compared to large, established companies. However, with careful research and due diligence, investors can identify smaller companies with strong growth potential and invest in them at attractive prices.

In conclusion, Warren Buffett’s strategy of focusing on smaller companies has proven successful. Investing in smaller sums offers advantages such as flexibility, diversification, and the potential to find overlooked opportunities. While the investing landscape may have changed, investing in smaller companies remains a viable strategy for those looking to replicate Buffett’s success.

Buying Businesses at Attractive Prices

Buying businesses or stocks at attractive prices is a fundamental principle in investing, and one that Warren Buffett has emphasized throughout his career. It is essential to find good businesses and purchase them at prices that offer value and potential for growth.

This advice is timeless and applies to investors of all levels of experience. By buying businesses at attractive prices, investors can maximize their potential for long-term success and wealth accumulation.

Individual thinking is crucial in this process. Investors should rely on their own analysis and judgment rather than simply following the crowd. Warren Buffett’s personal experience is a perfect example of this.

When Warren Buffett started investing, he focused on smaller companies that were often overlooked by other investors. By doing his own research and analysis, he was able to discover undervalued stocks and investment opportunities that others had missed.

By thinking independently and not relying on others, investors can uncover hidden gems and find investments with significant growth potential.

It is important to note that buying businesses at attractive prices does not guarantee success. There are risks involved, and thorough research and due diligence are necessary. However, by following this principle, investors can increase their chances of success and build substantial wealth over time.

In conclusion, buying businesses at attractive prices is a key strategy for successful investing. Warren Buffett’s personal experience highlights the importance of individual thinking and the potential rewards of discovering investments that others have overlooked. By focusing on good businesses and buying them at attractive prices, investors can position themselves for long-term financial success.