Table of Contents

ToggleIntroduction

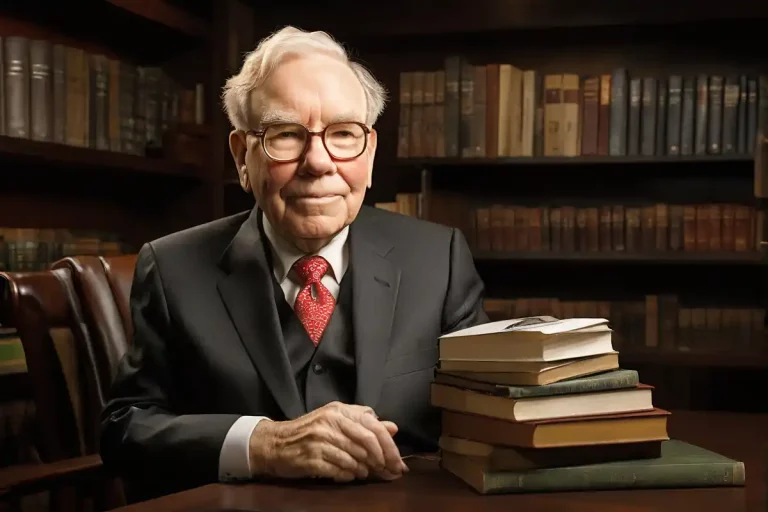

Books have always played a crucial role in personal growth and knowledge acquisition. They have the power to expand our minds, inspire us, and provide valuable insights into various subjects. One avid reader who understands the importance of books is Warren Buffett, often referred to as the Oracle of Omaha.

Buffett’s love for reading has been a driving force behind his incredible success as an investor and business magnate. From a young age, he immersed himself in books, starting with “1000 Ways to Make $1,000” at the age of seven. Since then, he has been devouring books at a rate of five to six per day.

Given Buffett’s voracious reading habit, it’s no surprise that he has developed a list of book recommendations that he believes can transform anyone’s skills and knowledge. These recommendations cover a wide range of topics, including investing, business management, and personal development.

So, what are the 16 books that Warren Buffett thinks everyone should read? They include classics like “The Intelligent Investor” by Benjamin Graham and “Common Stocks and Uncommon Profits” by Philip Fisher. Additionally, Buffett’s own letters to shareholders, compiled in “The Essays of Warren Buffett,” offer valuable insights into his investment philosophy.

While all of Buffett’s book recommendations are valuable, it’s essential to choose the best book that aligns with your specific goals and interests. Optimal learning and growth occur when you select books that resonate with you and provide the knowledge and guidance you seek.

In the following sections, we will delve deeper into each of these book recommendations, exploring their key themes, takeaways, and how they can contribute to your personal and professional development. Whether you are an aspiring investor, business leader, or simply someone looking to broaden your horizons, Warren Buffett’s book recommendations offer a wealth of knowledge and wisdom.

List of the 16 best books recommended by Warren Buffett:

- 1. The Intelligent Investor by Benjamin Graham

- 2. Security Analysis by Benjamin Graham

- 3. Common Stocks and Uncommon Profits by Philip Fisher

- 4. Stress Test: Reflections on Financial Crises by Tim Geithner

- 5. The Essays of Warren Buffett by Warren Buffett

- 6. Jack: Straight from the Gut by Jack Welch

- 7. The Outsiders by William Thorndyke, Jr.

- 8. The Clash of the Cultures by John Bogle

- 9. Business Adventures: Twelve Classic Tales from the World of Wall Street by John Brooks

- 10. The Little Book of Common Sense Investing by Jack Bogle

- 11. Dream Big by Cristiane Correa

- 12. The Most Important Thing Illuminated, by Howard Marks

- 13. First a Dream, by Jim Clayton and Bill Retherford

- 14. Poor Charlie’s Almanack, edited by Peter Kaufman

- 15. ‘Where Are the Customers’ Yachts?’ by Fred Schwed

- 16. The snowball: Warren Buffett and the business of life by Alice Schroeder

Summaries and Main topics of Books Recommended by Warren Buffett

- The Intelligent Investor by Benjamin Graham: This book is considered a classic in the world of investing and is a must-read for anyone interested in investing in stocks. The book teaches how to invest in stocks intelligently and how to avoid common mistakes made by inexperienced investors. The main keywords include: investment, stocks, fundamental analysis, technical analysis, margin of safety, intrinsic value.

- Security Analysis by Benjamin Graham: This book is another classic in the world of investing and is a must-read for anyone interested in investing in stocks. The book teaches how to analyze stocks intelligently and how to avoid common mistakes made by inexperienced investors. The main keywords include: investment, stocks, fundamental analysis, technical analysis, margin of safety, intrinsic value.

- Common Stocks and Uncommon Profits by Philip Fisher: This book is a must-read for anyone interested in investing in stocks. The book teaches how to invest in stocks intelligently and how to avoid common mistakes made by inexperienced investors. The main keywords include: investment, stocks, fundamental analysis, technical analysis, margin of safety, intrinsic value.

- Stress Test: Reflections on Financial Crises by Tim Geithner: This book is a must-read for anyone interested in understanding the 2008 financial crisis. The book offers an insider’s view of what happened behind the scenes during the financial crisis and how it was resolved. The main keywords include: financial crisis, bailout, monetary policy, fiscal policy, financial regulation.

- The Essays of Warren Buffett by Warren Buffett: This book is a collection of essays written by Warren Buffett over the years. The essays cover a wide range of topics related to investing and business. The main keywords include: investment, stocks, fundamental analysis, technical analysis, margin of safety, intrinsic value.

- Jack: Straight from the Gut by Jack Welch: This book is an autobiography of Jack Welch, the former CEO of General Electric. The book offers an insider’s view of Welch’s life and how he transformed GE into one of the most successful companies in the world. The main keywords include: leadership, management, strategy, innovation, transformation.

- The Outsiders by William Thorndyke, Jr.: This book is an analysis of eight CEOs who were able to outperform the stock market for a long period of time. The book offers insights into how these CEOs were able to outperform the market and what other CEOs can learn from them. The main keywords include: leadership, management, strategy, innovation, transformation.

- The Clash of the Cultures by John Bogle: This book is a critique of the investment management industry and offers an alternative view of how investments should be managed. The book argues that most investment managers do not offer real value to investors and that investors should focus on low-cost investments. The main keywords include: investment, investment management, mutual funds, ETFs, indices.

- Business Adventures: Twelve Classic Tales from the World of Wall Street by John Brooks: This book is a collection of stories about business and finance. The stories cover a wide range of topics, from the 1962 stock market crash to the rise of Xerox. The main keywords include: business, finance, history, Wall Street.

- The Little Book of Common Sense Investing by Jack Bogle: This book is an introduction to index investing and offers an overview of how investors can invest in low-cost index funds. The main keywords include: investment, index investing, mutual funds, ETFs, indices.

- Dream Big by Cristiane Correa: This book is a biography of Jorge Paulo Lemann, one of the richest men in Brazil. The book offers an insider’s view of Lemann’s life and how he became one of the most successful entrepreneurs in the country. The main keywords include: leadership, management, strategy, innovation, transformation.

- The Most Important Thing Illuminated by Howard Marks: This book is a collection of essays written by Howard Marks, one of the most successful investors in the world. The essays cover a wide range of topics related to investing and business. The main keywords include: investment, stocks, fundamental analysis, technical analysis, margin of safety, intrinsic value.

- First a Dream by Jim Clayton and Bill Retherford: This book is an autobiography of Jim Clayton, the founder of Clayton Homes, one of the largest manufactured home companies in the United States. The book offers an insider’s view of Clayton’s life and how he built his company. The main keywords include: leadership, management, strategy, innovation, transformation.

- Poor Charlie’s Almanack edited by Peter Kaufman: This book is a collection of essays, speeches, and comments by Charlie Munger, Warren Buffett’s business partner. The essays cover a wide range of topics related to investing and business. The main keywords include: investment, stocks, fundamental analysis, technical analysis, margin of safety, intrinsic value.

- ‘Where Are the Customers’ Yachts?’ by Fred Schwed: This book is a critique of the investment management industry and offers an alternative view of how investments should be managed. The book argues that most investment managers do not offer real value to investors and that investors should focus on low-cost investments. The main keywords include: investment, investment management, mutual funds, ETFs, indices.

- The snowball: Warren Buffett and the business of life by Alice Schroeder: This book is a biography of Warren Buffett, one of the most successful investors in the world. The book offers an insider’s view of Buffett’s life and how he became one of the most successful entrepreneurs in the world. The main keywords include: investment, stocks, fundamental analysis, technical analysis, margin of safety, intrinsic value.

Conclusion

In conclusion, Warren Buffett’s book recommendations offer a wealth of knowledge and wisdom for personal growth and development. Recapitulating the 16 books he suggests, these recommendations cover a wide range of topics, including investing, business management, and personal finance.

It is important to choose the right book that aligns with your specific goals and interests. Optimal learning and growth occur when you select books that resonate with you and provide the knowledge and guidance you seek.

By reading and implementing the lessons from these books, readers can gain valuable insights into various subjects and improve their skills and knowledge. Warren Buffett’s success as an investor and business magnate is a testament to the power of continuous learning and personal development.

Warren Buffett’s impact on the investment world and his success as an investor are unparalleled. His book recommendations offer a glimpse into his investment philosophy and provide valuable lessons for aspiring investors and business leaders.

In conclusion, reading and implementing the lessons from Warren Buffett’s book recommendations can contribute to personal and professional growth. By choosing the right books and applying the knowledge gained, individuals can enhance their skills, make informed decisions, and potentially achieve significant success in their endeavors.